Introduction to Futures¶

What is a Derivative?¶

Futures are an example of a simple derivatives. A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset, index, or security. Common underlying instruments are bonds, commodiities, currencies, interest rates, market indexes, and stocks. Derivative can be extremely complex but Futures contacts are a relatively simple derivative.

What is a Forward Contract?¶

Forward contracts are an agreement between two parties to pay a delivery price $K$ for some asset at some future time.

The person selling the asset is said to be in the short position, the person buying the asset is said to be in the long position.

For example, Billy runs a gas station and needs gasoline. Sandy produces gasoline in her refinery. Billy knows he will need Gas a year from now, but oil production fluctuates. Billy wants a way to guarantee a price a year from now. Sandy is also subject to the same fluctuations, she wants a way to reduce the volatility in her pricing a year from now.

This is where the forward contract comes in. Billy agrees to pay Sandy a fixed amount one year from now for a barrel of gasoline. Billy has entered the long forward position. Sandy has entered the short forward position.

So who is benefits from this transaction? This depends on the future price of gasoline. Let's walk through the two possible scenarios!

Scenario 1: Market Price Higher in the Future

Billy will pay \$100 for a barrel of Gasoline 1 year from now. Sandy agrees. A year passes and the market price of gas is actually \$150 a barrel! Billy now pays Sandy \$100 for the barrel. Saving himself \$50. In that case, the market price went up, meaning Sandy lost potential profit.

Scenario 2: Market Price Lower in the Future

Billy will pay \$100 for a barrel of Gasoline 1 year from now. Sandy agrees. A year passes and the market price of gas has crashed to \$25 a barrel! Billy now still has to pay Sandy \$100 for the barrel!! Sandy is happy because she now gets an extra \$75 above market value. Billy would have saved \$75 without the forward contract, but that takes risk!

So why would Billy and Sandy agree to a forward contract in the first place? It reduces risk on both sides, since both parties know how much the price will be in the future.

Obviously calculating the future price is critical, both parties are incentivized to get the best deal possible for themselves. We can actually formally described the payoff for for party mathematically.

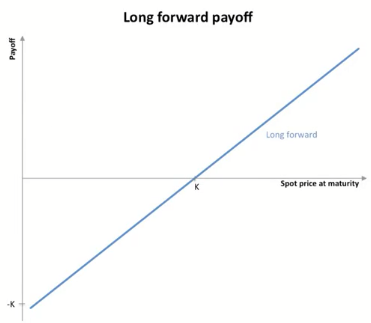

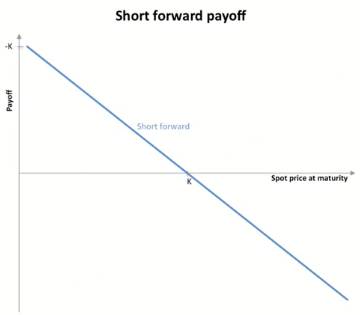

If we say $K$ is the predetermined future price and $S_T$ is the actual market price at time $T$, we can define the payoff for both the long party and the short party.

The payoff for the long position is: $S_T-K$

The payoff for the short position is: $K-S_T$

What is a Futures Contract?¶

Even though Forward Contracts are simple, there are some issues with them:

- Counterparty Risk

- Lack of Liquidity

- Need to negotiate many customized terms of contract

This is where Futures contracts come in! Future contracts are forward contracts that have been standardized for trade on an exchange.

A single futures contract is for a set amount of the underlying with agreed-upon settlement, delivery date, and terms. On top of this, the exchange acts as an intermediary, virtually eliminating counterparty risk.

The main idea of a Foward contract vs a Futures contarct is the introduction of the third party (the Exchange). Futures for a given asset are standardized, so the terms of corn futures may differ from the terms of pork bellies futures.

The existence of Futures contracts leads to Futures Speculation and Futures Hedging. Speculation occurs when market participants anticipate a price change in the underlying asset in the future.

They are settled daily with a margin account for a broker held by the holder of the futures contract. Each day, the change in price of the underlying is reflected in an increase or a decrease in the amount of money in the margin account. This process is called "marking to market"